tax sheltered annuity vs 403b

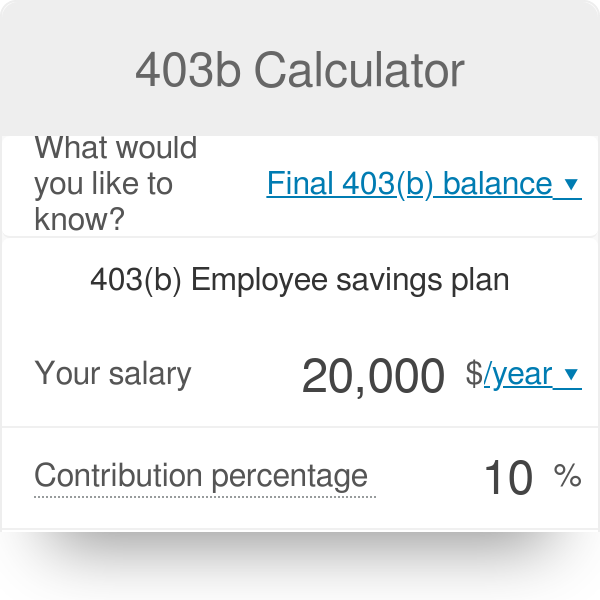

You can contribute as little as 15 per month or as much as 100 of your eligible compensation up to 20500 for 2022 in the UTSaver TSA Traditional and Roth combined. A 403 b plan sometimes called a tax-sheltered annuity plan is a type of retirement plan available to public school employees certain ministers and employees of.

Withdrawing Money From An Annuity How To Avoid Penalties

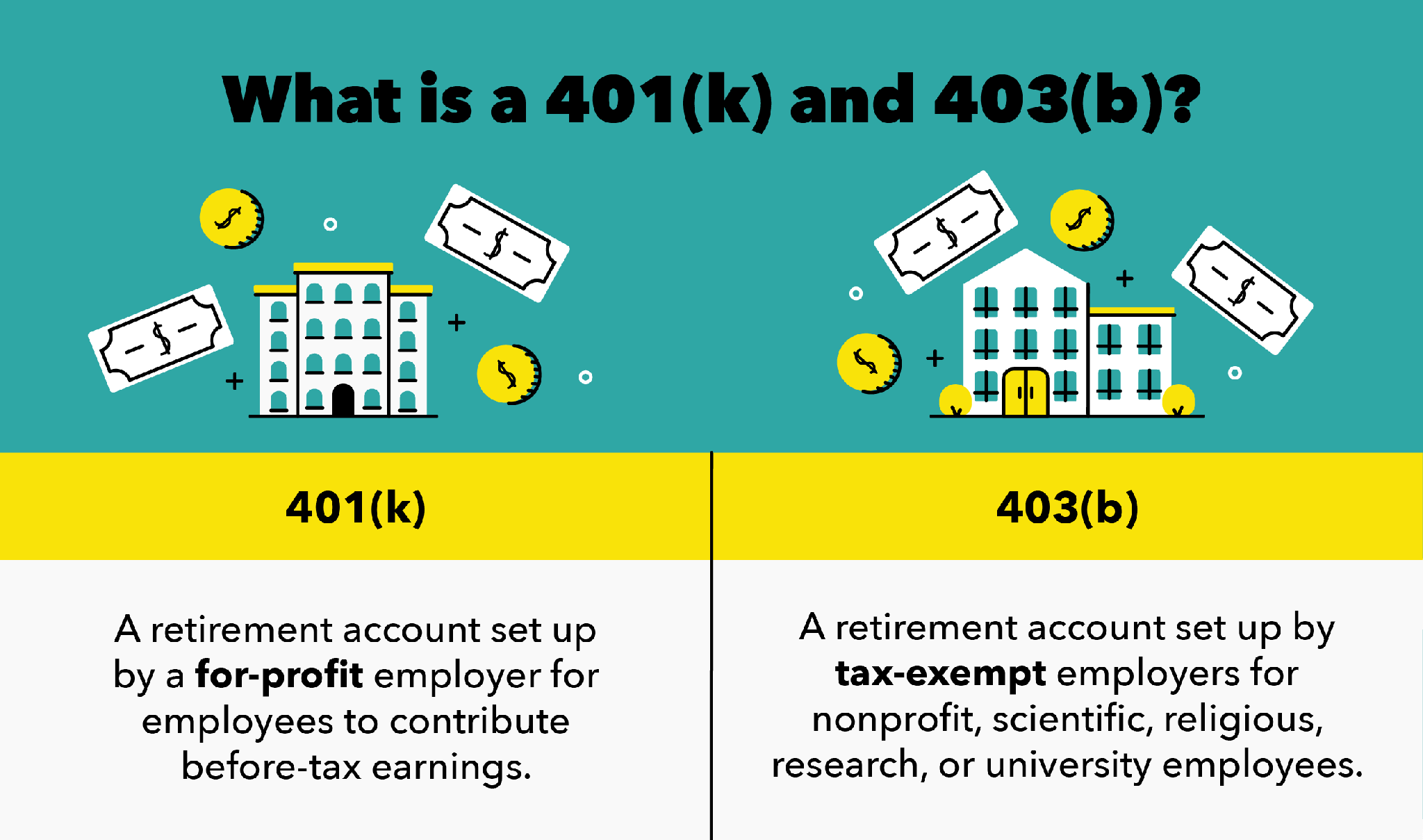

Nonprofits and public education institutions can establish tax-sheltered annuity plans often known as 403 b plans.

. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt. In essence they were fully portable pensions. IRC 403 b Tax-Sheltered Annuity Plans.

The regulations package reaches out beyond. A 403 b plan is very similar to 401. A 403b is an employer-sponsored retirement savings account sometimes also called a TSA tax-sheltered annuity plan.

What Are 403 b Annuities. These retirement accounts are typically offered by. A 403 b plan.

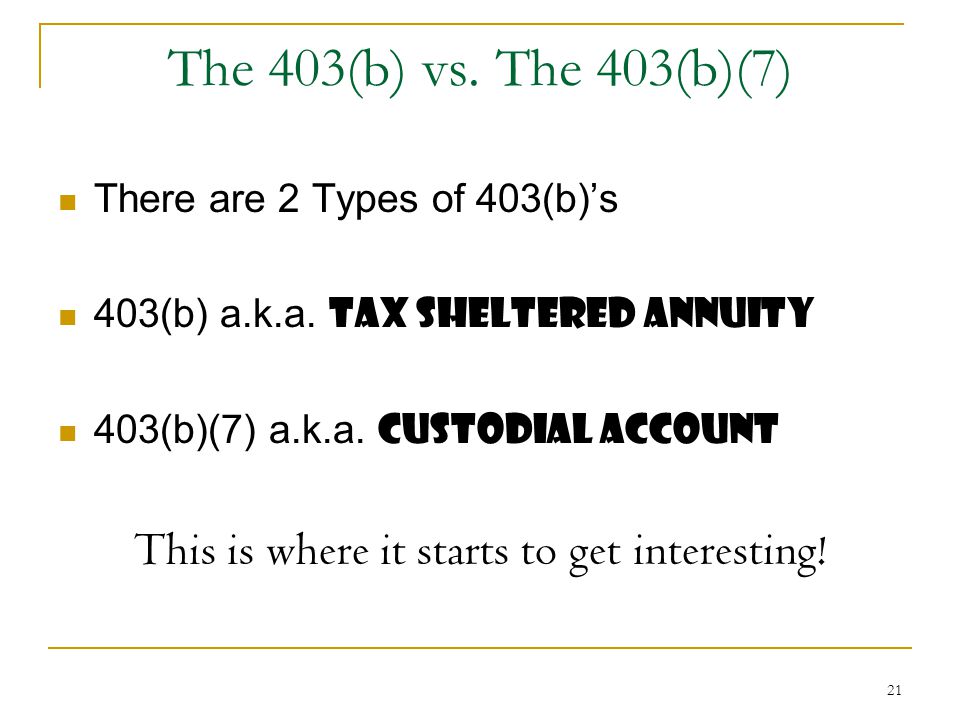

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. When the 403b was invented in 1958 it was known as a tax-sheltered annuity. So even though this.

In 1958 section 403 b of the Internal Revenue Code was put in place to limit the amount that could be contributed to such. A 403 b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers. A 403 b plan often referred to as a tax-sheltered annuity account TSA is a retirement plan offered exclusively by public schools and certain charities.

Tax Sheltered Annuity 403b Deferred Compensation 457. Content Deferred Compensation 457 Plan Early withdrawals IRC 403b Tax-Sheltered Annuity Plans When can I take money out of my TSA account. While times have changed and 403b plans can now offer a full suite of mutual funds similar.

They enable participants to invest pre. The UW 403 b Supplemental Retirement Program SRP formerly the UW Tax-Sheltered Annuity TSA 403 b Program allows employees to invest a portion of their income for retirement on. Overview of the 403b Final Regulations On July 23 2007 the first comprehensive regulations in 43 years were issued published July 26 2007.

2022 Plan Comparison. Tax Sheltered Annuity 403b Deferred Compensation 457 General Description A retirement.

What Is A 403 B Retirement Plan Contributions Withdrawals Taxes

Nonprofit 401 K The 403 B Plan Vs 401 K Plan Shortlister

What S The Difference Between 401 K And 403 B Retirement Plans

A Guide To The 403b Retirement Plan Sofi

403b Vs 457 How To Choose With Chart Educator Fi

403b Vs 401k Here S The Difference Arrest Your Debt

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

403 B Vs 457 B What S The Difference Forbes Advisor

Withdrawing Money From An Annuity How To Avoid Penalties

The 403 B The 403 B What Is It What S Wrong With It Ppt Video Online Download

Tax Sheltered Annuity A Term That Should Die Educator Fi

What Is A Tax Sheltered Annuity Due

What Is A 403 B Account And How To Make Yours Better Potomac

The Benefits Of A 403 B Retirement Plan Sdg Accountants

/images/2021/10/29/woman-on-phone-reading-paperwork.jpg)

Is A 403 B A Good Way To Save For Retirement The Pros And Cons Financebuzz

Roth Ira Vs 403b Which Is Better 2022

Annuity Articles Collection Of Annuity Retirement Articles On Various Topics